Why Aluminum Foil Containers Are the Future of Food Packaging?

In recent years, environmental protection trends have driven a surge in demand for aluminum foil containers, and aluminum foil packaging products have ushered in new opportunities under the global plastic ban wave.

1. Global plastic ban policy dynamics

EU: The Single-Use Plastic Directive (SUP) has been fully implemented, banning plastic tableware, straws, etc., and aluminum foil containers have become a compliant alternative for catering packaging.

USA: California, New York, etc. have gradually banned foam plastic takeout boxes, and the penetration rate of aluminum foil containers in fast food chains (such as McDonald's and Starbucks pilots) has increased.

Australia: The government announced the National Plastics Plan in 2021, with the goal of phasing out disposable plastic products (including straws, tableware, foamed polystyrene packaging, etc.) by 2025

Emerging markets: India and Southeast Asian countries (such as Thailand and Indonesia) have introduced plastic restriction timetables to promote the use of aluminum foil containers in street food and takeaway scenarios.

The global plastic food packaging market is about $53 billion (2023), and aluminum foil containers can grab at least 15%-20% of the replacement share (data source: Mordor Intelligence).

2. Environmental advantages and brand value of aluminum foil containers

Infinite recycling: Aluminum can be 100% recycled without loss of performance, and the recycling energy consumption is only 5% of primary aluminum (citing data from the International Aluminum Association).

Carbon footprint comparison: Aluminum foil containers have 40% lower carbon emissions than plastics over their entire life cycle (based on research by the European Aluminum Association).

Brand premium: Food brands using aluminum packaging can claim to be "green packaging" to attract environmentally friendly consumers.

According to news reports, after a European supermarket chain switched to aluminum foil lunch boxes, packaging waste was reduced by 30% and customer repurchase rate increased by 18%.

3. Key market growth insights and distributor strategies

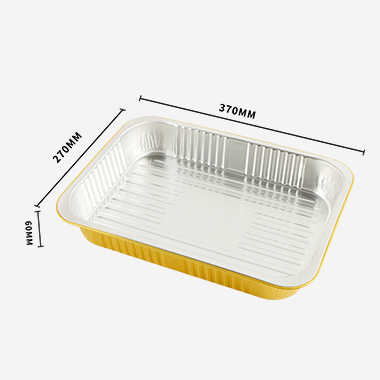

European and American markets: Focus on pre-prepared meals, baking (aluminum baking trays) and high-end takeout, preferring sealable containers with leak-proof designs.

Asian market: Southeast Asian food delivery platforms (GrabFood, Foodpanda) drive demand for small aluminum boxes; Japan and South Korea focus on microwave safety heating functions.

Middle East market: Demand for disposable tableware surges during Ramadan, and lightweight aluminum foil containers replace traditional plastic plates.

Australian market: The Australian food delivery market is worth more than A$7 billion (2023), with an annual growth rate of about 12%.

Driven by the plastic restriction policy, more than 60% of catering companies said they would give priority to purchasing recyclable packaging (Australia

Conclusion

The environmental protection trend is not only a policy requirement, but also a choice for consumers to vote with their wallets. Aluminum foil containers are becoming the core solution for global catering packaging upgrades with their recyclability, high performance and brand empowerment potential. Distributors can seize the opportunity through differentiated product portfolios (such as customized printing and functional design), while using environmental protection narratives to enhance customer value.